Access to Working Capital for MSMEs

Refer to the attached notification of Access to Working Capital for MSMEs

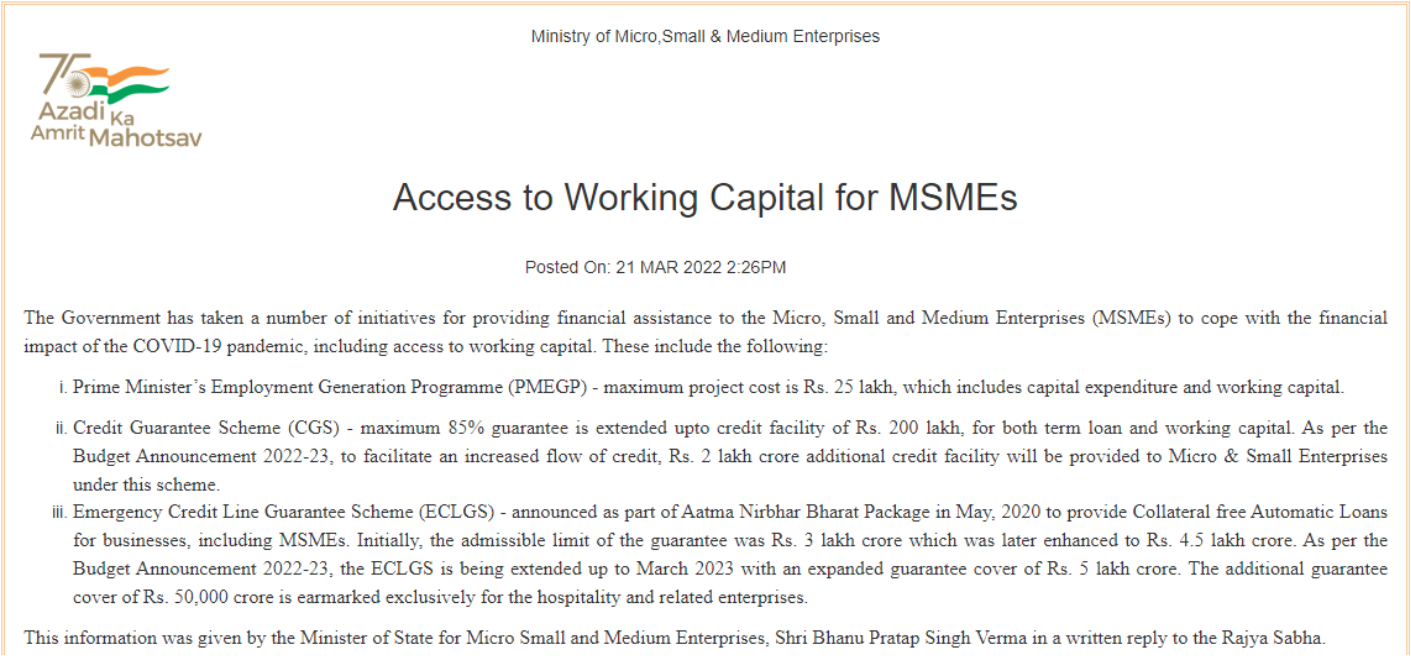

Ministry of Micro.Small & Medium Enterprises

Access to Working Capital for MSMEs

Posted on:21 MAR 2022 2:26PM

The Government has taken a number of initiatives for providing financial assistance to the Micro, Small, and Medium Enterprises (MSMEs) to cope with the financial impact of the COVID-19 pandemic, including access to Working capital. These include the following:

- Prime Minister’s Employment Generation Programme (PMEGP) – maximum project cost is 25 lakh, which includes capital expenditure and working capital.

- Credit Guarantee Scheme (CGS) – maximum 85% guarantee is extended up to a credit facility of Rs. 200 lakh, for both term loan and working capital As per the Budget Announcement 2022-23, to facilitate an increased flow of credit, Rs. 2 lakh crore additional credit facility will be provided to micro & Small Enterprises under this scheme.

- Emergency Credit Line Guarantee Scheme (ECLGS) – announced as part of the Aatma Kirbhar Bharat Package in May 2020 to provide Collateral free Automatic Loans for businesses, including MSMEs. Initially, the admissible limit of the guarantee was Rs. 3 lakh crore which was later enhanced to Rs.4.5 lakh crore. As per the Budget Announcement 2022-23, the ECLGS is being extended up to March 2023 with an expanded guarantee cover of Rs. 5 lakh crore. The additional guarantee cover of Rs. 50,000 crores is earmarked exclusively for the hospitality and related enterprises.

This information was given by the Minister of State for Micro Small and Medium Enterprises, Shri Bhanu Pratap Singh Verma in a written reply to the Rajya Sabha.