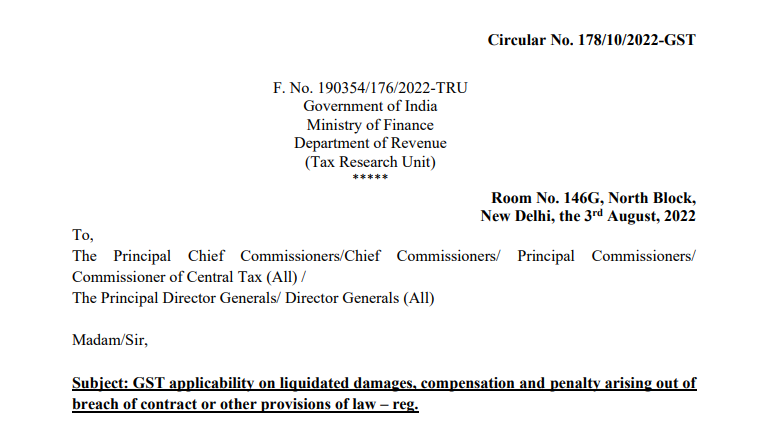

Posted Date: 3rd August 2022

Relating to which Act: The Central Goods and Services Act 2017

Type: Ministry of Finance, Department of Revenue, Government of India: Circular

Pertains to GST Payer, an individual coming into the ceiling of the Act.

Relevance of this news: Karma Management Global Consulting Solutions Pvt. Ltd is in the business of Payroll, Outsourcing, and Regulatory compliance since its inception in 2004 and since then, has brought in a lot of efficiencies and technological upgrades with experts on its roll, to ease the hassles of Payroll Processing, Temp Staffing On-boarding and providing customized solutions.

The Government has now announced vide the above circular about the taxability of an activity or transaction as the supply of service of agreeing to this obligation and if one refrains from the act, then GST on payments will apply in the nature of liquidated damage, compensation, penalty, cancellation charges, late payment surcharge, arising out of breach of contract if the same constitutes a supply within the meaning of the Act.

Subject: Agreeing to the obligation to refrain from an act or to tolerate an act or a situation, or to do an act” has been specifically declared to be a supply of service in para 5 (e) of Schedule II of CGST Act if the same constitutes a “supply” within the meaning of the Act.

Agreeing to the obligation to refrain from an act or to tolerate an act or a situation, or to do an act, has been specifically declared to be a supply of service under GST if it constitutes a supply

For greater details, attached is the notification