In what is expected to be such a huge relief for companies across India the government is mulling a high limit allowance at 75% of the wages of an employee in the first year of the rollout of the labour code on wages, which can then gradually be brought down to 50% which is as per current passed a bill of Code on Wages, people familiar with the deliberations told ET.

This is in alignment with what Karma had proposed to the authorities while interacting with them on suggestions and recommendations during the feedback conversations Karma had with them, the authorities are finally on the alignment of taking those feedbacks in terms of implementation. The authorities are in discussion to allow to keep up to 75% of wage as excluded components/allowances. In case this gets implemented, the employers will not have employee cost increase as against it is supposed to increase upon implementation of the codes.

The employers had resisted the move since it would result in higher employee costs. The employers were required to revise the entire salary structure based on the definition of the wages in labour code, which required 50% of the wage as a basic salary.

Under the code, wages include all remuneration by way of salaries allowances or otherwise and include basic pay, dearness allowance, and retaining allowance, if any, but excludes allowance such as house rent allowance and overtime allowance.

The code provides that if all these allowances not included in wages together exceed one-half percent or the percent so notified, the excess amount shall be deemed remuneration and added to basic wages under this clause.

Such an increase in wages would require higher payment to provident funds by both employer and employees and also raise gratuity payments. This would also reduce the take-home salary of workers/employees, though they would gain in a higher contribution to retirement savings.

The government is now discussing the changes that can be made to the code in view of concerns and resistance expressed, an official privy to the deliberations said.

Though the rules governing the four codes passed by Parliament were ready by March 2021, they have not been implemented because of the stiff resistance from employers and employees on certain issues. The industry fears the proposed changes in the code, at the time when the economy is still recovering from the impact of the pandemic, would put unnecessary pressure and increase their employee cost.

The resistance prompted the Centre to relook at necessary changes that can be made to ensure minimum additional liability on employers, especially now when the pandemic has hit the business hard, said another person aware about the deliberations.

The other major change under consideration is the restoration of the threshold on the number of employees in the organization to 100 from the proposed 300 under the Industrial Relations code for seeking the government’s permission before retrenchment or closing down operations.

This would give more businesses the freedom to manage their workforce without requiring government permission. Experts said tweaking some of the provisions might help the government win over the employers and trade unions’ confidence thus enabling the faster implementation of the codes which are critical to the ease of doing business.

What happens to an organization that has already changed the structure to 50% and already implemented anticipating the application of labour codes? Can it be now reduced to 25%? Will it be legal to reduce wages now? For answers to such questions and more information, for more details on the impact upon the implementation of labour codes and how it will affect you as an organization please get in touch with us at advisory@karmamgmt.com or enquiry@karmamgmt.com.

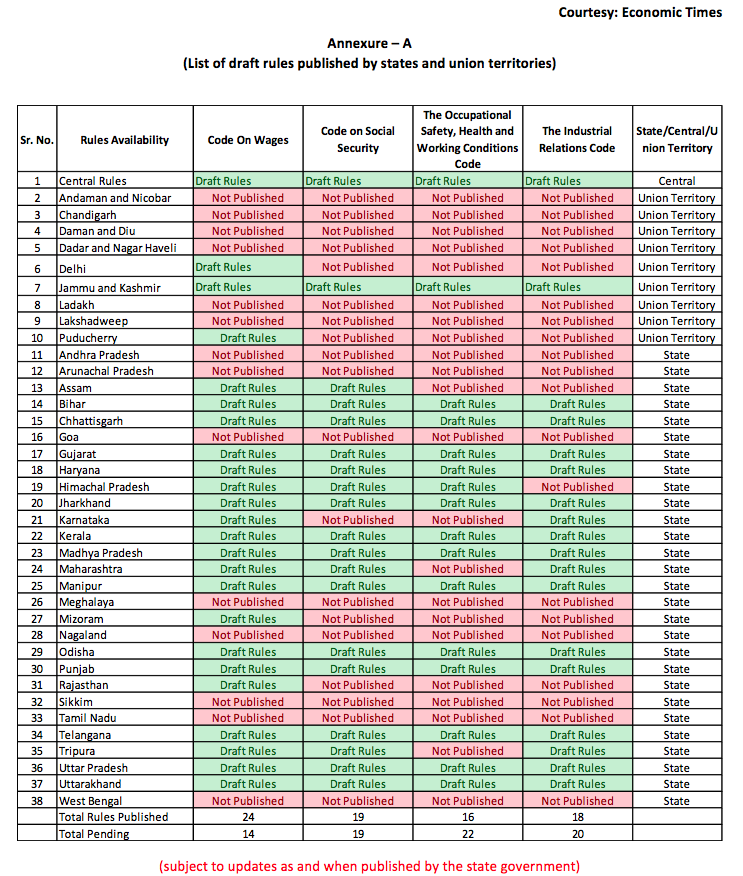

For greater details, find the attachment below