MSME federation FISME cautions businesses against alleged unethical practices by Axis Bank

Contents News/Article Date: 13th September 2022

Relating to which Act: Micro, Small and Medium Enterprises Development Act, 2006, MSME Development Act, 2006; MSME Udyam Registration under MSME Act

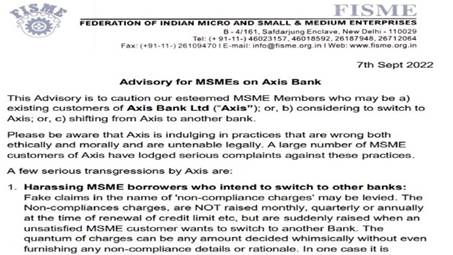

Type: Advisory Note from the Federation of Indian Micro and Small & Medium Enterprises to all its Members

Relevance of this news: Karma Global is a notable member of MSME for over a decade.

Karma Management Global Consulting Solutions Private Limited does a lot of compliance and legal work for a number of small and medium MSME Enterprises in relation to payroll, staffing, labour laws, HR services, training, and so on.

Karma Global also sends a lot of suggestions and advisories to officials on labour-related issues and the need for simplifying the outlook of some of these provisions affecting the business health of small enterprises.

You may all know that Form of Legal Organization under MSME Act – There is no particular form of legal organization to be adopted to be eligible under the MSMED Act. Benefits under MSME Act will be available so long as the enterprise satisfies the investment and specified turnover limits and has filed Udyam Registration.

According to the Notification dated 29-9-2006, the following type of enterprise may register as MSME:

- Proprietorship

- Hindu undivided family

- Association of persons

- Co-operative society

- Partnership firm

- Company

- Undertaking

- Any other legal entity

Most of the MSMEs are totally dependent on bank borrowings and in this instance, there is an issue with Axis Bank which are charging the small enterprises in the name of noncompliance, only those who want to switch to other banks.

Subject: MSME federation FISME cautions businesses against alleged unethical practices by Axis Bank

For greater details, appended below is the complete news item

MSME federation FISME cautions businesses against alleged unethical practices by Axis Bank

Credit and Finance for MSMEs: According to FISME, Axis Bank may levy fake claims in the name of ‘non-compliance charges’ against its MSME borrowers who intend to switch to other banks.

The association also claimed that the bank demanded foreclosure charges from 2 percent to 4 percent of the sanctioned limits from MSME customers who wanted to exit Axis Bank.

Credit and Finance for MSMEs: MSME representative organization Federation of Indian Micro and Small & Medium Enterprises (FISME) has leveled allegations of ‘unethical practices’ against private lender AXIS BANK in dealing with MSMEs. According to an advisory note issued by FISME on September 7, 2022, the federation cautioned MSMEs based on the “serious complaints lodged by a large number of MSME customers of the bank against such practices.” A copy of the note was seen by FEAspire (erstwhile Financial Express Online).

According to the note, the bank may levy fake claims in the name of ‘non-compliance charges’ against its MSME borrowers who intend to switch to other banks. “The non-compliances charges, are not raised monthly, quarterly, or annually at the time of renewal of credit limit, etc, but are suddenly raised when an unsatisfied MSME customer wants to switch to another Bank,” said FISME.

The quantum of charges can be any amount decided whimsically without even furnishing any non-compliance details or rationale, FISME said citing a case where 2 percent charges of cash credit limit were levied.

The federation, which reaches out to 2 million MSMEs through 740 associations, also claimed that the bank demands foreclosure charges from 2 percent to 4 percent of the sanctioned limits from MSME customers who want to exit Axis Bank.

“It is scandalous that in order to prop up profits, banks like Axis are imposing non-compliance and foreclosure charges on hapless MSMEs, defying the very banking code (Code of Banks Commitment to Micro and Small Enterprise) of which Axis itself is a signatory. Indian needs a separate banking regulator,” Neeraj Kedia, Chairman, Banking Committee, FISME told FEAspire.

However, Axis Bank denying FISME’s allegations told FEAspire, “As one of India’s largest private sector banks we continue to support the nation’s growth engine – the MSME sector – in every possible way. We are a large Bank with a growing MSME customer base that is diversified across geographies and sectors. This growth would not have been possible without the trust and faith that the MSME businesses continue to have in us and we take this responsibility very seriously.”

In a statement, Axis Bank added, “We categorically refute the baseless allegations made in this communication. All applicable charges and fees are very clearly and transparently communicated to our customers, prior to onboarding. The various lending facilities are provided to the customers only after getting the Sanction letter and loan documentation terms and conditions duly accepted by the customer.

“Further, we also have an effective customer redressal mechanism in place and have always taken any customer grievance with utmost seriousness and aimed to resolve it at the earliest. We would urge you to refrain from giving credence to such unfounded allegations,” the bank said.

Meanwhile, other charges leveled against Axis Bank by FISME were not releasing securities nor issuing no-dues clearances to MSMEs who intend to switch to another bank. Importantly, the federation had leveled similar charges against Kotak Mahindra Bank in April this year, however, the latter had “resolved foreclosure/ non-compliance related cases after having been brought to their notice by FISME,” it said.